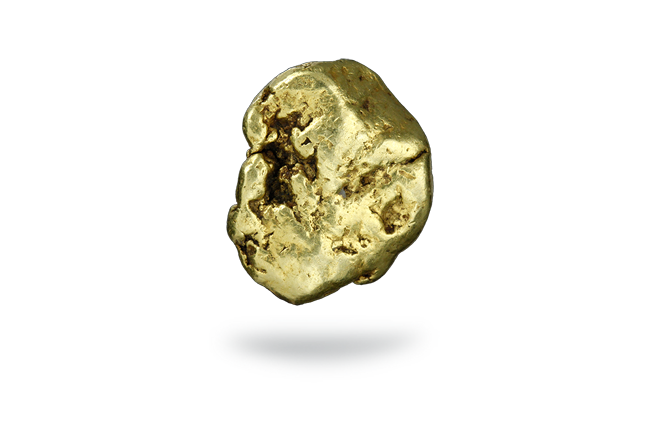

Gold

Of all the precious metals, gold is the most popular investment. Gold is a fixed part of the investment portfolio for many investors in order to spread risk. The gold market is subject to speculation and volatility, just like other markets. Compared to other precious metals used for investments, gold has historically been a good long-term investment.

Properties

| Name | Gold / Aurum |

|---|---|

| Price | ... |

| Highest price | $49,45 / oz (1980) |

| Production | China, Russia, Australia, The United States, Canada, Ghana, Brazil, |

| Produced in 2021 | 3.000 tons (96 million oz) |

| Areas of application | |

| Jewelery and Embellishment, Telecommunications (mobile, satellite), Aerospace, Computers, Electronics, Coins and Medals, Dental Technology, Investments | |

Price history

Gold is a stable factor in an investment portfolio. Traditionally, investors fall back on this precious metal in times of crisis. The amount of gold on earth is finite and the increasing demand has been driving the price upwards for years.

Investing in coins

Gold coins can be a better investment compared to gold bars. Gold coins are sold at margin and without taxes. The margin represents the portion that the selling party earns from the sale of the coins. The government sees the currency as legal tender and therefore does not charge taxes.

Invest in bars

Gold bars are less interesting as an investment in some countries due to the fact that VAT has to be paid on them. However, there are options to buy the product in some stores, but have it stored abroad. With large investments, the purchase of gold bars is therefore still interesting because the margins are sharper that way.

Gold, king of metals

Gold is a precious metal which is a chemical element from nature, therefore it is unfortunately not infinitely available. For decades, we've been mining gold to use it as a medium of exchange or a luxury product. The scarcity in combination with the limited availability ensures that the gold price continues to rise.

Gold is a chemical element with the symbol Au or the Latin name aurum. After gold is mined, it enters a process to purify it. This is to ensure that a purity - measured in carats - can be given to the gold. There are different carat levels. The purest gold is 24 carats, this is also the most precious form in which you can buy carats.

The purity of gold

What does carat say about the purity levels of the gold?

As a handy rule of thumb you can remember 'One carat of gold is 1/24th part pure gold'. Because pure gold is soft and therefore pliable and more prone to wear. People consciously choose to mix them with other metals. This creates the different gold contents and different colors. Adding silver, copper and/or platinum is also called an 'alloy'.

Form the lowest carats, the 8 and 9 carats may no longer be called gold in some countries (including the Netherlands), but in Germany and England they are. So when buying, pay attention to the number of karat gold that is stated in combination with the price.

| Carat | Purity | Definition |

|---|---|---|

| 24k | 99.99% | 999 |

| 22k | 91.67% | 916 |

| 20k | 83.3% | 833 |

| 18k | 75% | 750 |

| 14k | 58.3% | 585 |

| 9k | 37.5% | 375 |

Is gold stable?

Due to its scarcity, gold has a stable price, but like any price, the gold price fluctuates with the economy. In economic crisis, investors turn to gold because the investment is less dependent on investor sentiment. After all, there is a tangible product under the investment.

What is 1 troy ounce of gold?

To facilitate the trading of gold, they have agreed a standard worldwide. These names can be found on both the coins and the bars. The standard name they use is '1 troy ounce'. A troy ounce is a measure of weight for precious metals. It is exactly 31.1034768 grams.

Popular gold investment products

Consumers or companies looking to invest in gold are turning to gold coins internationally also known by the term 'gold bullion'. These gold bullions or gold coins are still accepted as legal means of payment and are therefore exempt from VAT in a number of countries. Worldwide there are a number of well-known gold coins that are issued a limited edition each year for that year by the relevant countries.

Gold Bullion Coins

American Gold Eagle Coins were first minted in 1986 by the United States Mint. The Golden Eagle Coin is gold mixed with silver and copper to create a sturdy material to prevent wear and tear. The bald eagle is depicted on the face of the coin. The reverse features the Augustus Saint-Gaudens design of Lady Liberty with wavy hair and a torch in her hand. The American Golden Eagle Coin has a purity of .9167 or 22 carats.

American Gold Buffalo Coin is a relatively young coin. The American Buffalo was only launched in 2006, it is the first time the United States produced a pure (.9999) 24 carat coin. The front shows an American Buffalo with the numerical value of $50. Because the circulation is so limited and the gold price is only rising, it is a popular coin.

Australian Gold Kookaburra Coin has been designed and marketed since 1990. The Kookaburra, also known as the laughing bird, is Australia's national bird. The bird is from the kingfisher family Halcyoninae. Perth Mint is Australia's official government agency that mints the Gold Kookaburra coin every year. They have a purity of 99.99% and come in the sizes 0.5 gram, 0.1 troy ounce, 2 troy ounce, 5 troy ounce and 10 troy ounce.

Australian Golden Kangaroo Coin comes from the Perth Mint in Australia. The Australian Kangaroo was first introduced on a gold coin in 1986. However, no kangaroo was visible on the coin at that time. It was not until 1989 that the Australian kangaroo appeared on the obverse. Because it is 99.99% pure 24 carat gold, it is a beloved coin in the world.

Chinese Golden Panda Coin was launched in 1982. The Golden Panda Coin always has a picture of the Temple of Heaven on the obverse, while there are yearly changing designs of the iconic Chinese Panda on the front. rear end. The Chinese Panda Coin is issued by People's Republic of China in different weight class.

Canadian Gold Maple Leaf Coin was first minted in 1979 with a high karat purity of .999. From 1979 to 1982 the Canadian Maple Leaf was only available in the 1 troy ounce, it was only after 1982 that the Royal Canadian Mint started producing more weight variants. The reverse of the coin features Queen Elizabeth II of the Commonwealth. The purity of the Maple Leaf Gold Coin was increased to .9999 in 1982.

Krugerrand Gold Coin has a long history, the first coins were introduced in 1967 as a way of realizing gold ownership. The Krugerrand Gold Coin has a special pinkish glow because it is alloyed with copper. The composition consists of 91.67% gold and 8.33% copper. It has been a conscious choice to mix Krugerrand Gold Coin so that the material is stronger and less damaged when traded.

Vienna Philharmoniker Gold Coin has been launched by the Austrian Mint since 1989. Currently, this is one of the few gold coins or gold bullions in Europe that are still being produced. The Vienna Philharmonic Gold Coin has no mintage limit and therefore has a higher trading volume in contrast to other types of gold coins.

Where is the best place to buy Gold?

Only you can decide where to buy the best gold. Are you in gold for collectible value or as an investment? The margin in combination with the factors such as purity, availability, damage and delivery time are all factors that count. TheMetalVein.com helps you and looks across country borders which gold coin or bar is your best purchase. View all gold coins and bars on TheMetalVein, scroll through the website, use the filters and discover your favourite.